child tax credit for december 2021 amount

The two most significant changes impact the credit amount and how parents receive the credit. For children under 6 the amount jumped to 3600.

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules.

. Up to 3600 per child under age. While the General Assembly sets the amount of the foster care payments funding for payments comes from a combination of federal state and county money. However the deadline to apply for the child tax credit payment passed on November 15.

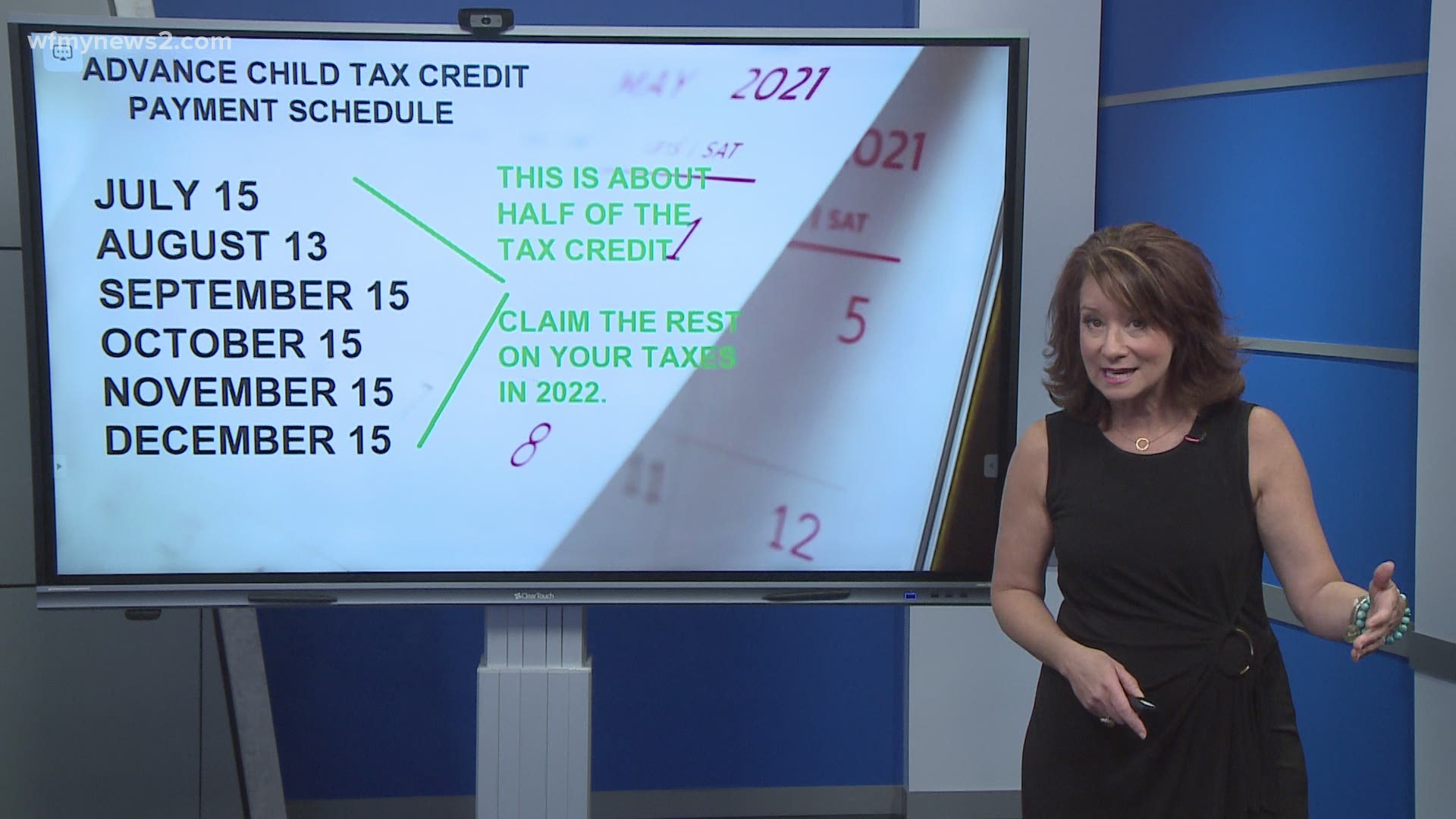

The CTC amount will start to gradually decrease. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. The amount changes to 3000 total for each child ages six through 17 or 250 per. What Will be the.

First the credit amount was temporarily increased from 2000 per child to. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. 15 per month per child is.

The IRS will send you monthly payments for half your new credit between July and December 2021. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. A single taxpayer with 2 qualifying children and modified adjusted gross income MAGI of 80000 can claim a Child Tax Credit of 1750.

Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self Employed These updated FAQs were released to the public in Fact Sheet 2022-32 PDF July 14 2022. To be a qualifying child for the 2021 tax year your dependent generally must. Your newborn should be eligible for the Child Tax credit of 3600.

Lowers the phase out rate. Number of Children x 2000. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child.

2 days agoAfter the advance federal Child Tax Credit ended in December 2021 low-income families with kids struggled the most to afford enough food. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. A childs age helps determine the amount of Child Tax Credit that eligible parents.

It also provided monthly payments from July of 2021 to. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. That comes out to 300 per month through the end of 2021 and 1800 at tax time next year.

The credit amounts will increase for many. Your newborn child is eligible for the the third stimulus of 1400. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

If you did not receive the stimulus for a.

What You Need To Know About The Child Tax Credit Sunlight Tax

Stimulus Update December Child Tax Credit Payment To Hit Bank Accounts This Week Silive Com

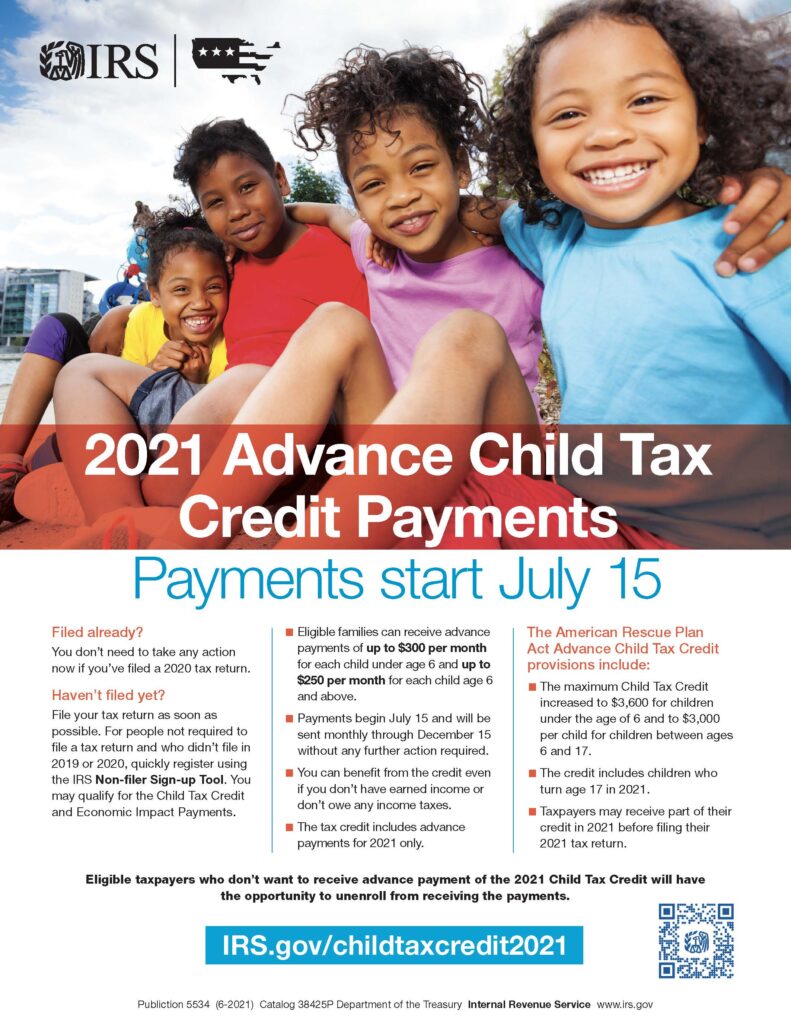

Fact Sheet Advance Child Tax Credit

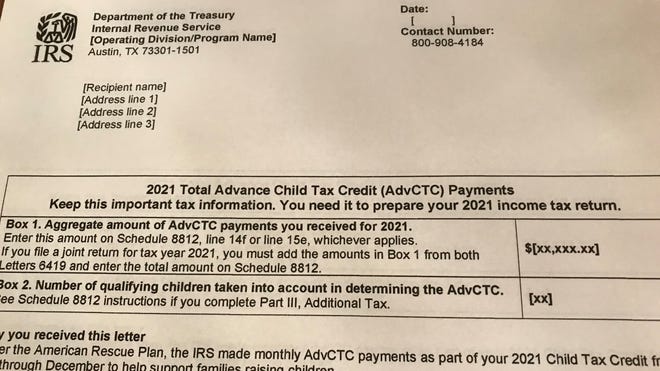

Advance Child Tax Credit Payments Anfinson Thompson Co

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

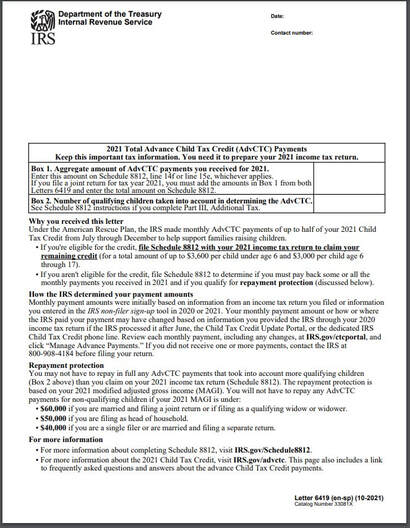

What Is The Irs Child Tax Credit Letter 6419

Child Tax Credit Payment Schedule For 2021 Kiplinger

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All The Us Sun

Families Will Soon Receive Their December Advance Child Tax Credit Payment

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

The Policy Debate At The Heart Of The Biden Manchin Standoff The New York Times

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

First Phase Ending For Child Tax Credit A Game Changer For Families